The year 2024 has arrived and there’s one thing on every investor’s mind: which stock is the best to invest in? Given the rapid development of new technologies everyone wants to invest in stocks of tech giants like Apple, IBM, Meta and many others. However the problem is that it’s essential to thoroughly analyze an Apple stock before investing in it. This is where the financial experts at FintechZoom can be of great help to you.

As a stock market expert at Fintechzoom I’m here to delve into the factors that could influence Apple’s stock performance and provide valuable insights to help you make informed investment decisions.

Will Apple Stock Hit New Highs in 2024?

Apple (AAPL) has been a consistent performer in the stock market, consistently returning impressive returns for its investors. However, with the broader market facing uncertainties in 2024, many investors are wondering: can Apple stock reach new highs this year?

Let’s see what the financial experts at Fintechzoom have to say about this.

How is the recent performance of Apple Company?

Before we analyze the future price of Apple stock let’s first understand its recent performance.

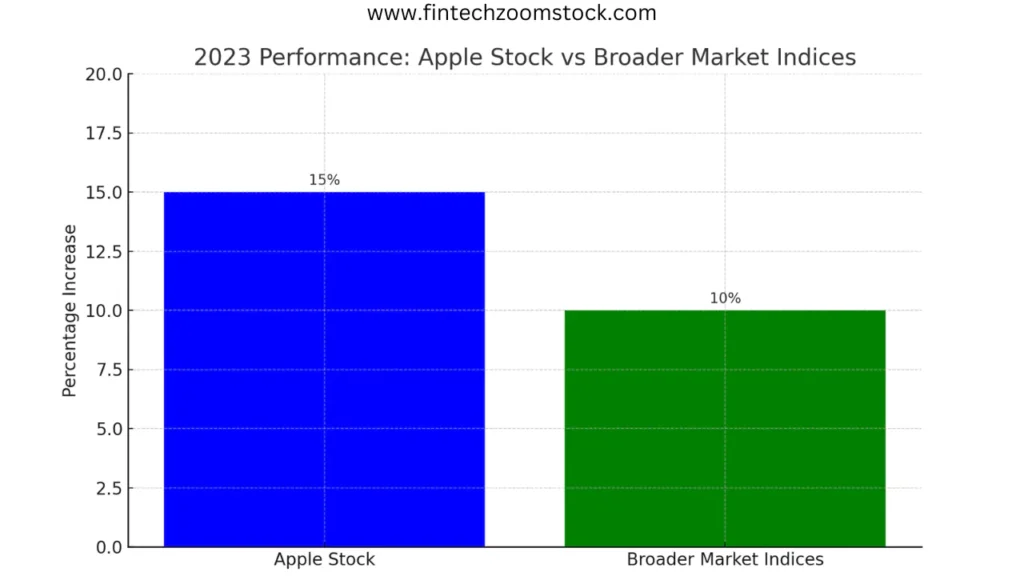

In 2023 Apple stock experienced a 15% increase and surpassed the performance of the broader market indices.

This outstanding growth can be attributed to several factors including:

- Strong iPhone Sales of 2023: The iPhone Apple’s best flagship product and 2023 saw continued strong demand for the latest iPhone models and particularly the iPhone 15, iPhone 15 Pro and iPhone 15 Pro Max.

- Apple Product Services Revenue Growth: Apple’s services segment ( Apple App Store, Apple Music and Apple iCloud ) Thrived in 2023 December with a 20% revenue growth and highlighting the power of their recurring income model.

- Apple is launching a lot of wearable products right now: Apple Watch and AirPods continue to be popular choices and contributing significantly to the Apple company’s wearables segment. In 2024, Apple has made its mark in the new tech world. Apple launched the “Apple Vision Pro” which has been quite successful. This detail witnessed a 30% growth in revenue in 2023.

Extra Information: The Apple Vision Pro is based on VR (Virtual Reality) technology.

Fintechzoom Experts Analyzing Apple Stock Fundamentals for Potential Growth in 2024

After thoroughly analyzing the fundamentals financial experts at FintechZoom are observing that Apple’s stock price could significantly increase in 2024.

Let’s understand the fundamentals analysis in full detail.

Apple Company’s Financial Strength

Apple Tech Company has a strong financial position with a healthy cash flow and low debt levels.

This financial strength allows the company to invest in research and development and expand its product portfolio and make strategic acquisitions all of which can fuel future growth.

Apple’s Future Innovation

Apple is renowned for its commitment to innovation. The company consistently develops new and improved products and keeps its customers engaged and loyal.

Upcoming product launches such as the rumoured AR/VR headset (AR = Augmented Reality and VR = Virtual Reality) and the next-generation Apple Watch could be major catalysts for stock price growth in 2024.

Apple’s Brand Loyalty

Apple enjoys exceptional brand loyalty among its customers. This loyalty translates to consistent demand for its products and services and provides a solid foundation for future growth.

Global Market Reach

Apple has a strong global presence with a significant customer base in developed and emerging markets. This global reach provides the company with ample opportunities for further increase and market share growth.

Apple Stock Price May Fall in 2024

Let’s see if Apple’s stock price can reach new highs in 2024 but there are certain challenges that could also lead to a decline in the stock price.

let’s understand in more detail.

Global Economic Slowdown

The global economy is currently experiencing a slowdown and concerns about a potential recession are swirling.

This could have a significant impact on consumer spending money and particularly on discretionary areas like smartphones.

If consumers tighten their belts then apple’s iPhone sales a viral revenue stream could suffer potentially affecting the company’s stock price.

Supply Chain Disruptions

The tech industry and the world in general have been a hassle with supply chain disruptions for several years.

These disruptions can lead to shortages of critical components, production delays and ultimately in meeting consumer demand.

If Apple continues to face these challenges in 2024 then it could struggle to fulfill orders and maintain its market share and potentially affecting investor confidence and stock price performance.

Compete with Technology Sector Competitors

The tech industry is a battlefield and Apple faces both established and emerging competitors contesting for market share.

Main tech industry players like Samsung and Xiaomi constantly innovate and offer compelling alternatives to Apple’s products.

Also, new entrants in the wearables and AR/VR markets could disrupt Apple’s position in these growing segments and force the company to adapt and compete aggressively to maintain its leading edge.

these competitive pressures could limit Apple’s growth potential and pose challenges for its stock price in the ahead.

Apple’s main target is to remain at the forefront of the tech industry and its primary competitor is Samsung.

Interestingly, the screens Apple uses in its iPhones are actually provided by Samsung.

Apple Stock Technical Analysis

Fintechzoom financial experts are conducting a technical analysis of Apple’s stock (AAPL) and see a high chance of the stock price decreasing.

There’s a normal support at $168 but the main support is at $123.

If we compare it with the RSI there was a higher chance of the price going down.

Important Note: Always conduct your analysis before investing in any stock. Do not invest based on someone else’s recommendation. You can gain knowledge from Fintechzoom but the investment decision is yours to make.

Here are some key factors to watch in the coming months:

- iPhone 16 launch and sales performance

- Progress and reception of the rumored AR/VR headset

- Growth of Apple’s services segment

- Overall economic conditions and their impact on consumer spending

By closely monitoring these factors investors can gain valuable insights into Apple’s future prospects and make informed investment decisions.

Conclusion

Investing in any stock involves inherent risks.

However, for investors with a long-term investment plan Apple with its strong fundamentals, innovative spirit and loyal customer base presents a compelling opportunity.

While there are challenges to consider the potential rewards for patient investors could be significant.

As always conducting thorough research and due diligence before making any investment decisions is crucial.

Disclaimer:

This article is for informational purposes only and should not be considered financial advice.